Occasionally a customer will complete an order that is taxed, only to return with a Sales Tax Certificate and ask for a credit. In this case there are two primary outcomes that we are looking to achieve.

1. We want the credit to post to the customers Accounts Receivable Balance.

2. We want to reduce the amount of Sales Tax that you remit to the taxing authority at the end of the period.

For the purposes of this post, I will outline two different scenarios, Invoice Already Paid and Invoice is Unpaid.

Invoice Already Paid (or) Taxing Period Closed

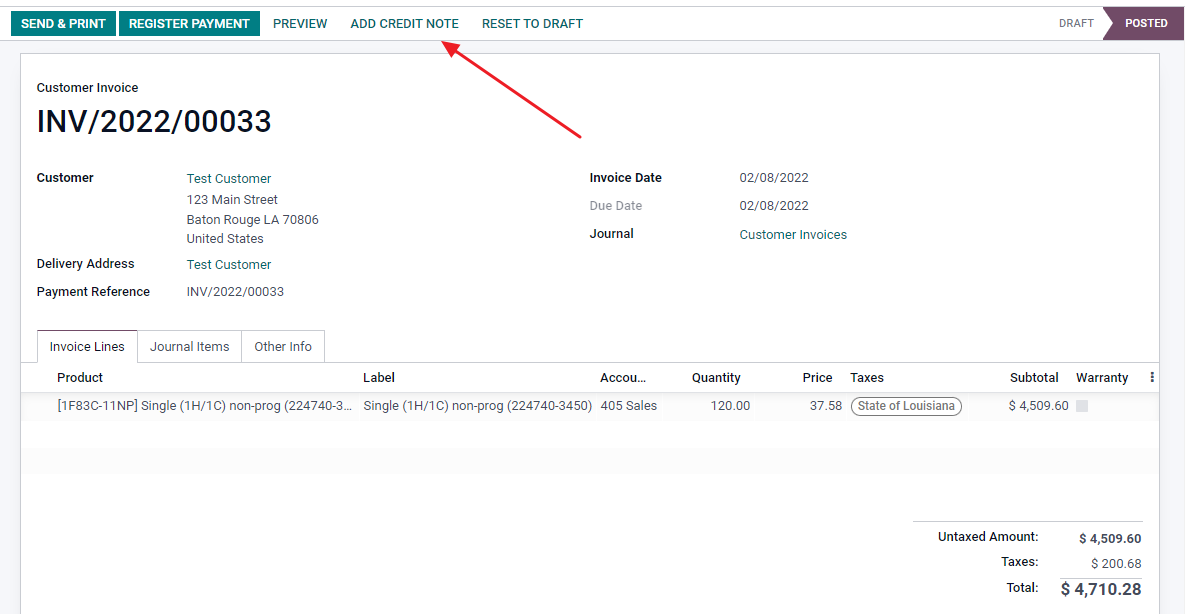

In the event the invoice is already paid or the taxing period is closed, you want to issue the customer credit directly from the originating invoice.

- Issue a credit from the Invoice by clicking "Add Credit Note"

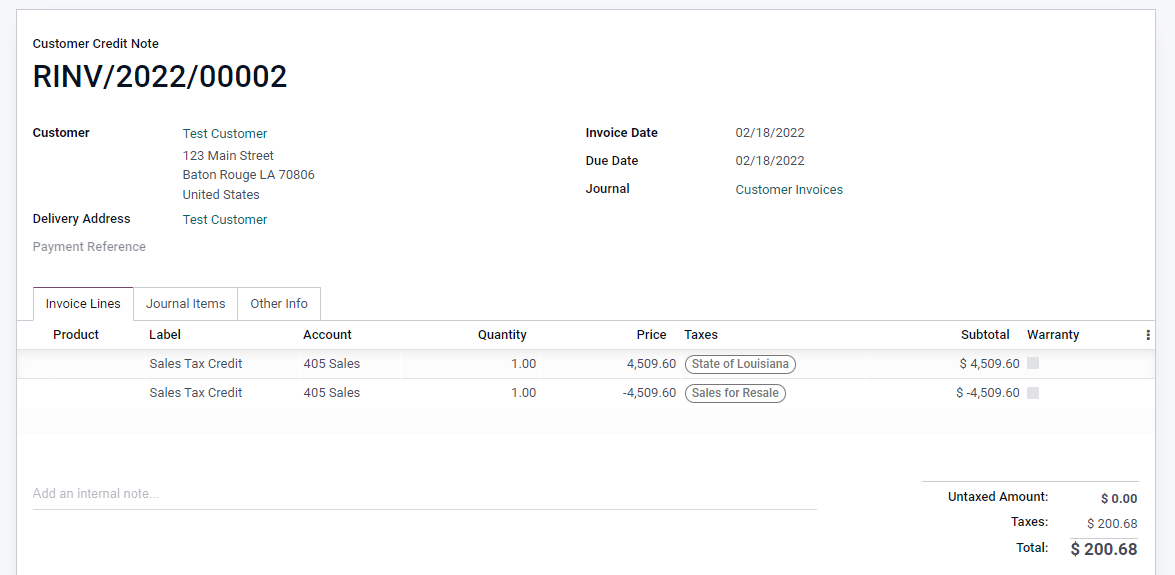

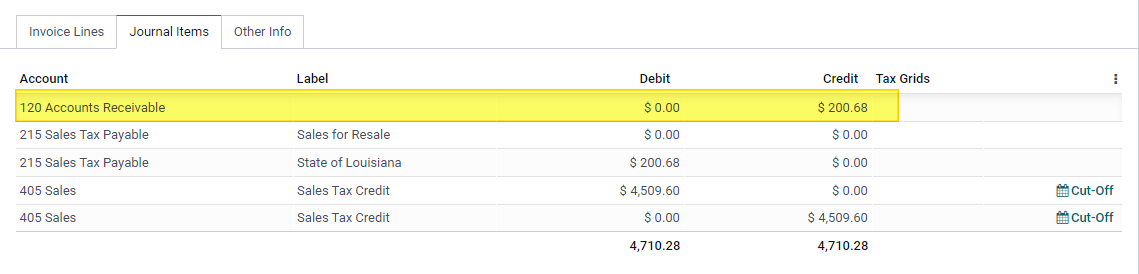

- Remove all lines, create two lines for tax credit. Use the same Income Account as the originating invoice to represent the entire taxable amount from the invoice you are attempting to credit.

- On the second line, reverse out the taxable amount so that the only amount that lives through is the tax from the first line. Choose the reason for the Tax Credit as the negative line. This will reclassify your income on your tax report.

- At this point the credit will be issued to the Accounts Receivable and can be used in the future by the customer or refunded if necessary

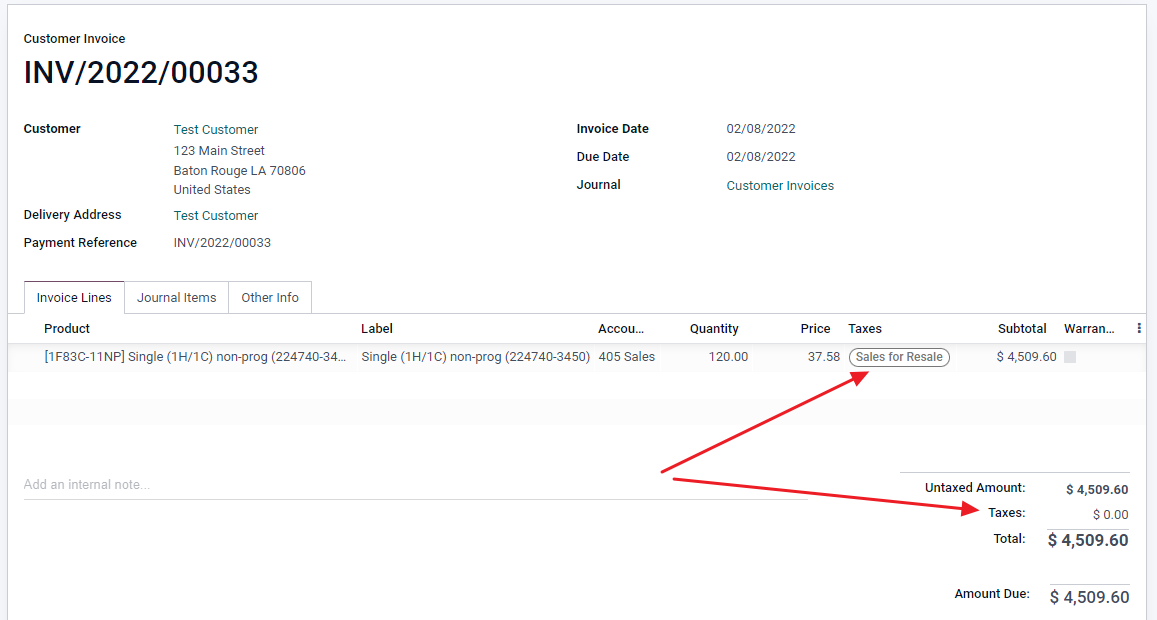

Invoice is Unpaid

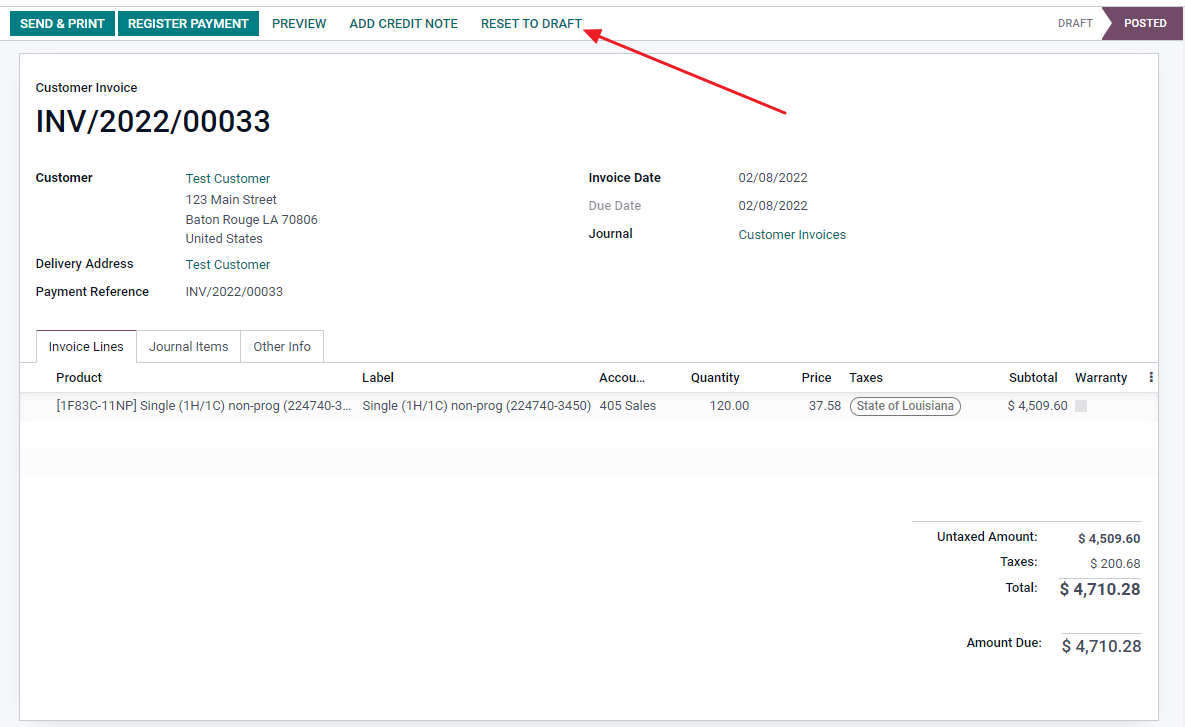

If the invoice is un-paid and you have NOT filed your sales tax for the period you can simply cancel the invoice and reset the invoice lines to correct taxes. This easy process gives you the ability to make the adjustment to the original invoice.

Let it be noted that some accountants might not like this method and it should be done in consideration with your company accounting methods.

- Cancel the Invoice by clicking "Reset to Draft"

- Replace the taxes on the invoice lines with the appropriate tax condition or change the fiscal position if all lines should be updated.

- Re-Post Invoice - This will update the tax report accordingly and will not require issuance of a new customer credit. A new version of the revised invoice can now be sent to the customer.