For new users of Odoo, configuring your inventory valuation settings are an important part of a successful implementation. You should seek out a qualified partner to help you fine tune these settings and make sure they meet the requirements of your CFO and Inventory Managers. The automation of journal entries based on stock moves is a powerful feature to help your balance sheet properly reflect the value of inventory on hand, and the value of inventory coming in and going out of the company daily.

Please Note: This post is mainly focused on what Odoo calls "Anglo-Saxon Accounting" which is commonly used in the United States and meets GAAP standards. Odoo also offers a "Continental Accounting" standard which is more common in Europe. Finally, this post does not cover accounting of inventory used in manufacturing (WIP).The decision of which inventory valuation settings are appropriate for you can really be summed up into two questions.

Do you want your inventory moves to be reflected in changes to your balance sheet?

If so, Do you want to use a Standard Cost, Average Cost, or FIFO valuation method.

Automated vs. Manual

Automated inventory very simply means that Odoo will create a journal entry upon receipt of goods, shipment of goods, and invoicing of goods automatically.

| Journal Entry Timing | Account | a.k.a. |

| Stock Receipt | Stock Input Account | Un-Invoiced Goods Received (UIGR) |

| Stock Shipment | Stock Output Account | Un-Invoiced Goods Delivered (UIGD) |

| Invoice to Customer | Expense | Cost of Goods Sold (COGS) |

Manual (also sometimes called "Periodic") inventory valuation means that the accounting team is responsible for making manual entries on a periodic basis usually monthly or quarterly. In this method, the balance sheet is not updated daily, but only upon the end of the period when the company takes a physical inventory.

This calculation is fairly simple and is better for companies that do not have very tight control of their inventory on a daily basis. Lack of inventory control in this concept does not mean that the company is not doing a good job, it just means that the products being inventoried are not easily trackable.

To calculate the value of the inventory the simple formula below is necessary:

(Beginning inventory) + (inventory purchases) - (ending inventory) = Cost of goods sold

Costing Methods

There are three types of costing methods available to Odoo users when their inventory is automated.

Standard Cost - A cost is defined by the company for the product and each one sold is given the same value on the balance sheet. The value is not re-calculated ever by Odoo, but simply assigned by the user during product setup.

Average Cost - An average is calculated by Odoo of all quantities of the product in inventory.

FIFO - First In First Out inventory is the most commonly used method in North America. Very simply, as each product is received into inventory its value follows it through the entire inventory process. The value of inventory shipped is such that the oldest item in inventory is always the next value assigned to the shipment.

Applying Settings

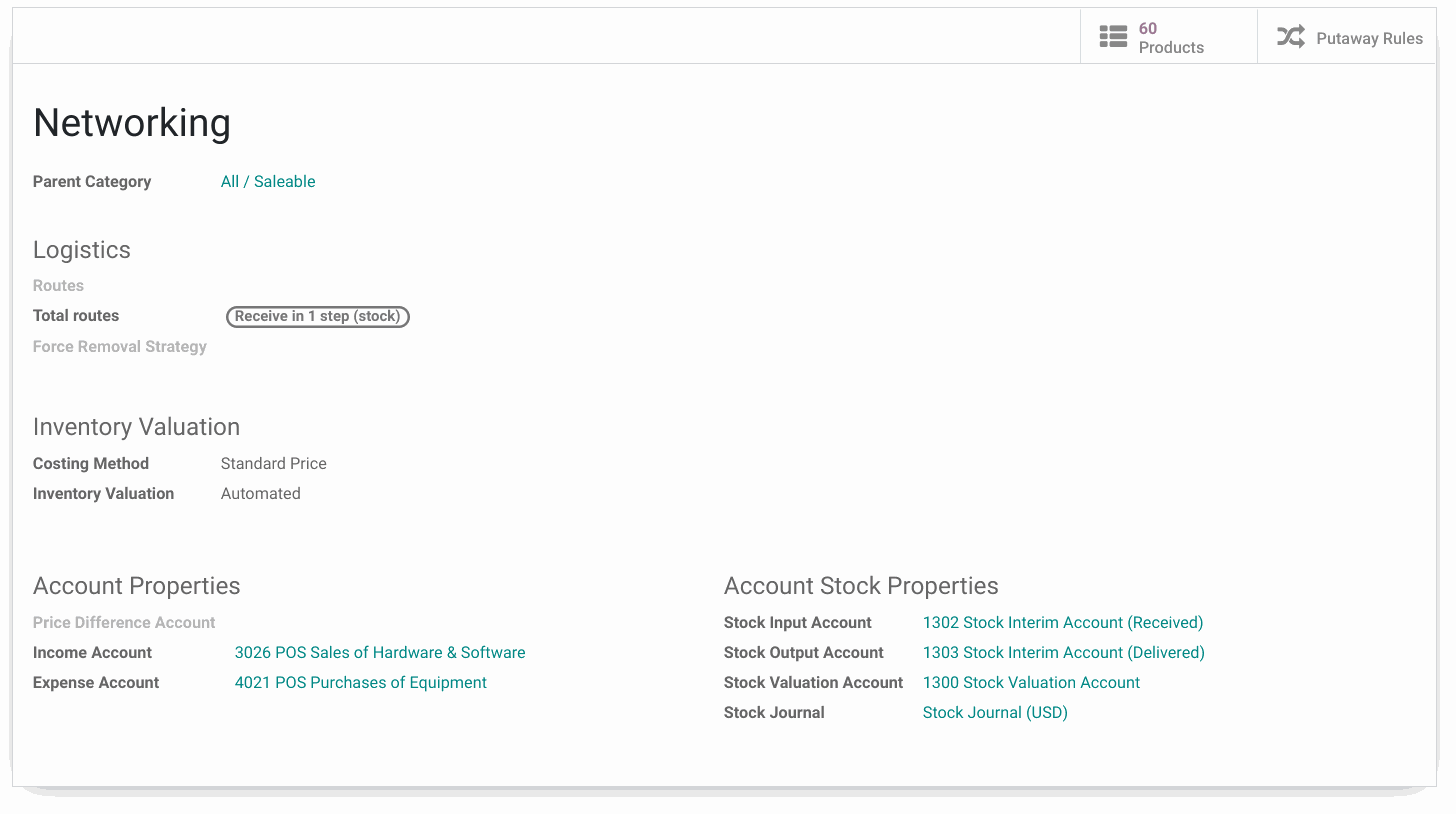

Inventory Valuation settings are assigned at the product category level in Odoo. In most cases, products with similar attributes are grouped together into a product category. Each category can be assigned different inventory valuation accounts and settings.

For example, consumable products like gloves or boxes could be set to manual inventory valuation for a company but higher value items may be set to automated inventory valuation. Note that when I say consumable I do not mean the "Product Type" setting in Odoo, but the general term of consumable to represent supplies that are not easy to track and are generally expensed upon receipt by most companies.

The above example shows a product category for network equipment. This inventory is set to automated inventory valuation with a costing method set to Standard Cost. Each additional product category can be configured differently based on your requirements. The great part about this type of configuration is that the management of the company can define the valuation strategy, but the inventory team is not required to understand it completely. The inventory team is only responsible for choosing the correct category for new products to be put into upon new product setup.

Summary

Inventory Valuation can seem a little overwhelming at first when configuring Odoo. After consulting with your partner, you should be able to replicate these settings easy for a predictable outcome based on your inventory moves going forward.

To test and understand these inventory valuation settings further, I highly suggest the valuation tool published by Odoo